TANDX::Institutional Shares

Castle Tandem Fund Update

Per usual, and this quarter being no different, with 90% of S&P 500 companies having reported 2nd quarter earnings, 75% of companies have beaten their EPS estimates. On the surface, it is a good thing for companies to exceed their expectations. Although estimates are being beaten, the actual results are far from stellar. According to Factset, the current blended earnings growth rate for the 2nd quarter stands at -0.7%. This will be the first time since the 1st and 2nd quarters of 2016 that the S&P 500 has reported two straight quarters of an earnings decline. Looking forward, analyst estimates are currently predicting an additional quarterly decline for the 3rd quarter of -3.1%, which is a deceleration from its estimate on March 31st and June 30th of +1.1% and -0.6%, respectively.

The continued deceleration has been a major theme this earnings season in the S&P 500 aggregate earnings, but it has also started rearing its head in a few of our core holdings. For much of the year, our core holdings have held up very well. We’ve seen several companies get ranked a sell by our quantitative model for valuation reasons, but fundamentally the companies were continuing to post accelerating growth, which nullifies the sell signal. As mentioned before, our quantitative model is multi-factor, so valuation alone doesn’t trigger action on our part.

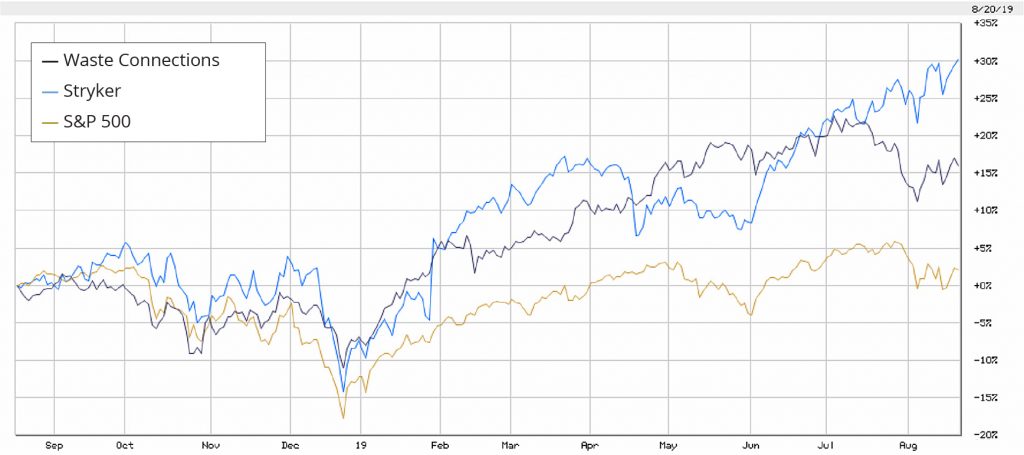

Over the past few weeks, we’ve trimmed the Fund’s positions in Stryker Corp. (SYK) and Waste Connections, Inc. (WCN). Both companies have performed very well, outperforming the S&P 500 over the past year ending August 19, 2019. In each case, the companies’ share price has significantly outpaced their sales and earnings growth. This has led to both SYK and WCN being overvalued. And, even though both companies are reporting growth, this was the first quarter that each showed a deceleration in this growth going forward. Therefore, we adhered to our sell discipline and reduced our position size by approximately 25%.

Financial Markets Review

Game on. That is what the Chinese declared last week after President Trump tweeted the United States would slap tariffs on the remaining $300 billion of Chinese imports starting on September 1st. The trade spat between the U.S. and China has officially been turned up a notch and financial markets around the world reacted in-kind.

For much of July, global financial markets remained relatively calm. Currencies, commodities and fixed income stayed in fairly tight ranges. Specifically, the 10-year U.S. Treasury yield seemed to finally find a floor around 2% after declining most of the year. Volatility, as measured by the VIX, was anchored around the 12 level, which was last seen in April of this year and mid-September of last year. The calm markets allowed the S&P 500 to gradually climb a couple of percent throughout most of July and ultimately set an all-time record intraday and closing high on July 26th. No more than 2 days later, the Federal Reserve cut the Fed funds rate by 25 basis points, which was widely expected. However, the market wasn’t prepared for Fed Chair Powell’s ensuing remark of this rate cut just being “a mid-cycle adjustment and not the beginning of a long series of rate cuts.” That statement was certainly not dovish enough for markets, and not what President Trump wanted to hear. Those few words were all it took to set the stage for the events of the past week.

President Trump has certainly not been shy in voicing his displeasure for the U.S. Federal Reserve. And, I don’t believe it was just a coincidence that he decided to turn up the heat on China just days after the Fed made no intention to embark on a sustained rate cutting cycle. If the Fed wasn’t going to give him what he wants, then he was going to force their hand. The day after the Fed’s announcement, the market was pricing in a 77.5% chance of an additional 25 basis point rate cut at their next meeting on September 18th. As of today, the market is pricing in a 100% chance of a rate cut in September – a 76.4% probability of a 25-basis point cut and a 23.6% probability of a 50-basis point rate cut.

China’s reaction to the threat of additional tariffs was also not what markets were expecting. The big blow came when China allowed their currency to depreciate below 7 yuan to the dollar. A trade war is one thing, but a currency war is taking it to a whole different level. The devaluation of the Chinese currency makes Chinese exports cheaper, which effectively cancels out the cost of the tariffs. However, if the Chinese are willing to let their currency depreciate to boost their exports with cheaper goods, you better believe other countries will do the same to stem any economic weakness. The “race to the bottom” will end up being a vicious cycle where all economic activity just comes to a halt, because no one would trust each other. In addition, all outside investment geared toward future growth would dry up, because no person or company in their right mind would want to put capital at risk in a country that is willingly depreciating its currency.

The effects of a potential currency war have been immediately reflected in asset prices since the start of August. The 10-year U.S. Treasury bond fell 40 basis points over the course of 5 trading days. Considering the 10-year Treasury was only trading around 2%, a 40-basis point move is stunning! Those 5 trading days also saw the following:

- VIX more than doubled

- Copper (industrial metal) fell over 7%

- Gold (safe-haven metal) climbed over 7%

- Dow Transports fell nearly 8%

- Crude oil dropped 13%

All the while, the S&P 500 posted its worst day of 2019 on August 5th with a nearly 3% decline. By the end of the week, most of that decline was taken back during an extremely volatile week of trading. Although the S&P 500 sits only 3.5% below its all-time high, the damage has been done in most other asset classes. Commodities and fixed income are both pointing to a further decline in economic activity. The spread between 2-year and 10-year U.S. Treasuries continues to flatten, while the short-end of the curve has extended its inversion. The spread between the 3-month Treasury bill and 10-year Treasury bond is now at its most extreme inversion since 2007.

With U.S. equity prices telling one story and fixed income telling another, investors are bound to be confused. And, confusion breeds volatility and opportunity. The volatile nature among all asset classes is most likely here to stay for the foreseeable future, which will lead to many investment opportunities for those that are patient.

Billy Little, CFA

Lead Portfolio Manager

Castle Tandem Fund

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

As of June 30, 2019, Stryker Corp. (SYK) and Waste Connections, Inc. (WCN) represented 2.18% and 2.03%, respectively, of the Castle Tandem Fund’s total net assets.

Earnings per share (EPS) is a company’s net income divided by the outstanding shares of its common stock. The VIX is a market index that measures the expectation of near-term volatility. The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing.

The prospectus contains this and other important information about the Fund, and it may be obtained by calling

1-877- 743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.